As a result of Covid-19, self-service banking has shifted from nice to have to must have. As Doug Brown, Senior Vice President & General Manager at NCR Digital Banking, has said “The ability to access money and banking services anywhere and anytime has proven essential.” As consumers transition, one of the side effects has been contact centers have been inundated with customers and members needing information.

By sending personalized relevant messages to the right member at the right time, banks and credit unions have significantly reduced the number of calls to their contact centers.

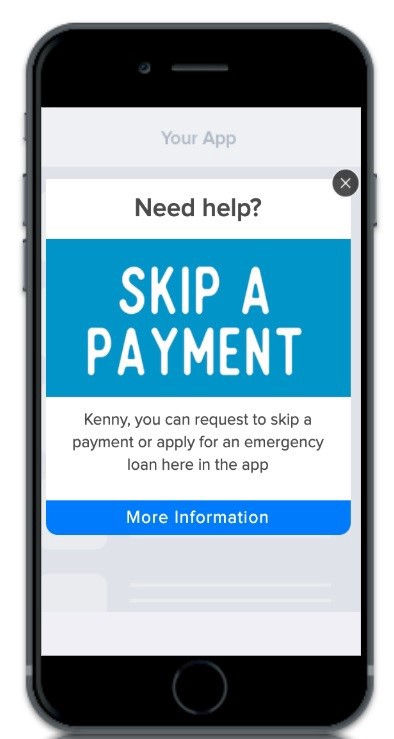

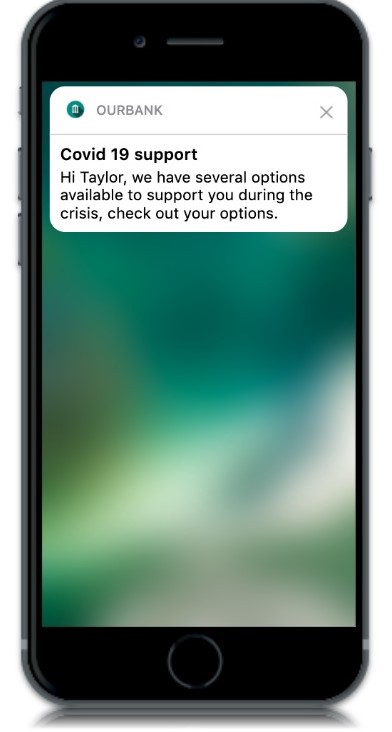

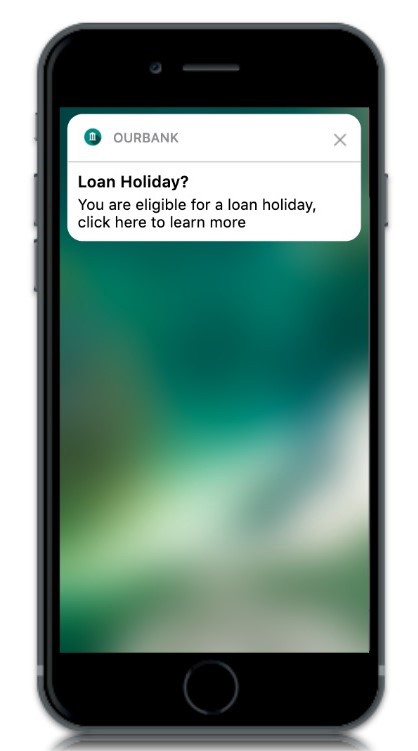

Banks and financial institutions using Pulsate have been proactively informing their customers instantly about the financial supports that they need. Financial institutions have been proactively communicating with customers and members about PPP loans, loan holidays, skip a pay options, emergency loans and other supports.

This type of proactive communication helps to build trust and strengthen customer relationships by exceeding customer expectations. They deliver relevant information to the right customers and members proactively so that they don’t need to seek it out. This enables banks and credit unions to serve more customers with less resources. As a result, there is more peace of mind for customers and members and less stress for agents.

Since March 2020, we’ve seen a 300% surge in usage of our platform by our banking clients. They want to always keep their customers and members informed and reassured during these difficult times as they seek to reduce financial anxiety.

For example, many banking members are in need of services such as loan holidays. In fact, several financial institutions who were experiencing as much as a 700% increase in calls to their contact centers identified loan holiday requests as a primary topic. Using Pulsate they have been able to segment their members and send messages to only those with loans to inform them of the options available to them.

The results of reaching customers and members proactively through app notifications are immediate with contact center volumes reducing to more manageable levels. This approach is saving financial institutions time and money. Ultimately, they have greater customer and agent satisfaction due to more efficient banking at a time when communication and empathy are needed more than ever.

To learn more, contact us here today.

HAVE YOUR SAY. LEAVE A COMMENT