It’s fair to say that GDPR caused a lot of convulsions just over a year ago when it was introduced. Organisations of every size spent months planning for the changes around data protection and user privacy and in many ways we are still adapting to a post GDPR world.

However, while seemingly everyone knows about GDPR, another EU regulatory acronym has so far gone largely under the radar. SCA hasn’t received the same amount of attention just yet but it is likely to impact a significant amount of online transactions in Europe. And unlike GDPR, SCA will start costing everyone who accepts online transactions straight away. Read on to find out more about SCA and how mobile app owners can prepare and ensure that their bottom line is not negatively impacted.

So what is SCA?

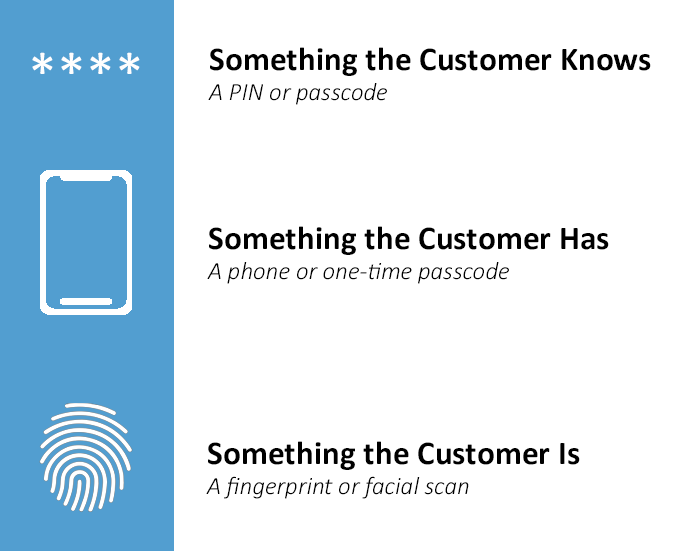

SCA stands for Strong Customer Authentication and it is a new regulatory requirement that is being introduced in Europe on September 14th, 2019. Part of the EU’s second Payment Services Directive (PSD2), SCA requires that all online transactions that take place in Europe are authenticated by at least two out of a possible three independent authentication methods.

The three listed authentication methods are:

For more info on rules and exceptions related to Strong Customer Authentication, check out this comprehensive post by Braintree.

In practice, this means that most customer initiated online transactions in Europe will require at least one extra authentication step to be taken by customers when they want to make an online purchase. Although there are some restrictions to the scope of SCA, including that both the business selling the product and the cardholder’s bank are based with Europe, it will still affect a significant amount of online transactions.

In fact, Mastercard predict that 1 in 4 online transactions will require extra authentication steps due to the new SCA rules.

How will SCA Impact Mobile Apps?

Transaction processes are some of the most complex user flows on mobile. Let’s breakdown the typical steps required to complete a transaction to outline exactly how complex the user journey can be. In a typical mobile app, users are already required to take the following steps to make a purchase:

- Find a product that they like at a price that is acceptable.

- Select whatever size or configuration of that product they wish to purchase

- Add the product to their cart.

- Choose the quantity of that product that they wish to purchase.

- Move the product from the cart to their basket.

- Select a delivery address.

- Select a payment method.

- Validate that payment method by entering their CVV number or logging into Paypal etc.

- Select whatever shipping options they require if it is a physical product.

- Review all of the previous information and click purchase.

That’s ten steps just to purchase a physical product and that assumes that the user has already registered their details and added shipping and payment options. Since more transactions are taking place on mobile, the user is probably doing other things and/ or travelling at the same time so it’s not surprising that cart abandonment rates on mobile are extremely high.

SCA is going to add even more complexity to checkout flows. The new regulations will undoubtedly cost mobile app owners a significant amount of revenue that will be lost to even higher abandonment rates. In fact, some reports predict e-commerce losses of up to €57 billion due to the new directives.

How can Pulsate help?

While it is undoubtedly true that that significant revenue will be lost, app owners have a unique opportunity to try and reduce the amount of friction caused by the introduction of SCA. The first part of solving any problem is to diagnose the severity of the issue.

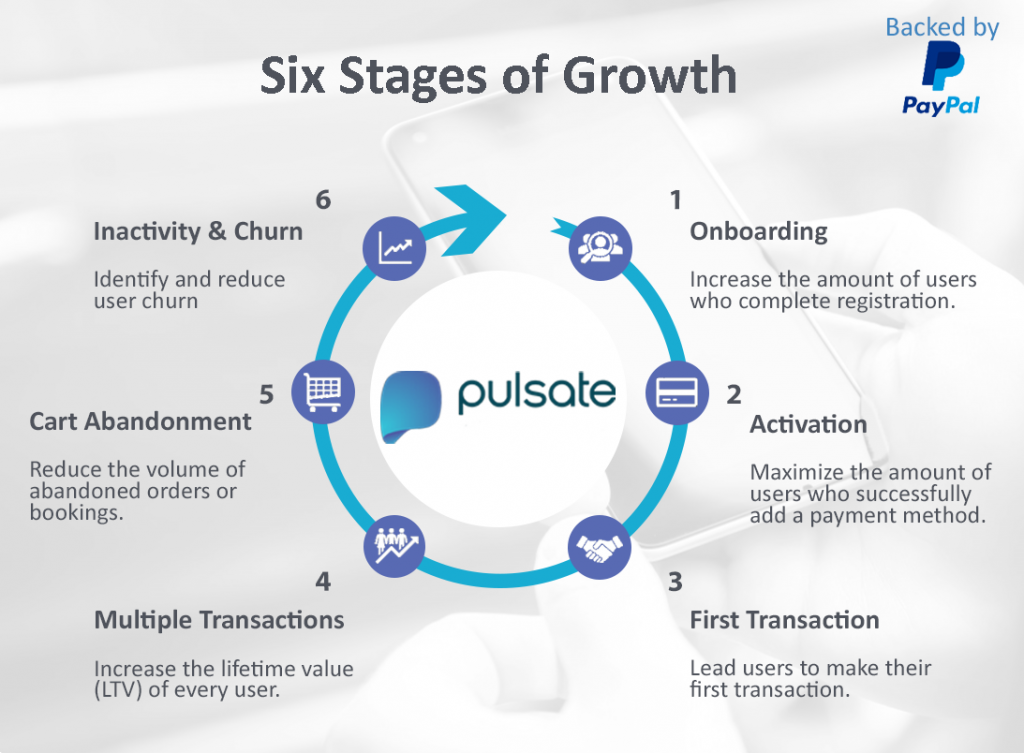

At Pulsate, we help app owners diagnose where exactly users are dropping off and running into bottlenecks based on the Six Stages of Mobile Growth:

Each stage represents a key growth marker in the typical customer journey of an app user. Each app will have different priorities but for apps that are required to introduce SCA, cart abandonment is likely to be the key growth stage that they need to concentrate on.

Pulsate can intelligently identify exactly where users are running into issues during a cart or checkout flow and how many users are running into bottlenecks due to the authentication requirements that will have to be introduced via SCA.

Are users having issues entering a pin or perhaps they are running into a problem with biometric face or fingerprint scanning? With Pulsate the guessing game is removed and you can concentrate on optimizing the experience for every user based on the data that Pulsate provides.

This data is extremely valuable and it allows app owners to carry out three important actions to tackle the issues introduced by SCA.

Real-Time Personalized Automation

Reacting immediately to issues that users run into making transactions should be a key goal for any app that wants to minimise the amount of revenue that is lost due to the introduction of SCA. Users abandon payment flows because they get frustrated with roadblocks and don’t understand how to proceed. Often, lots of customers run into the same easy to fix problems but they don’t know how to fix them.

Pulsate can reach out to those users in real-time at the exactly right moment with personalized content about how to solve the common issues they run into. This real-time personalised automation provides the user with the tools they need to complete the transaction.

Handover to Live Chat

Sometimes users will need assistance from a customer support agent to solve the issues that they encounter when trying to make a purchase. Live chat functionality is a core Pulsate component and this allows us to seamlessly route users who have difficult issues to a live chat agent straight away so that the problem can be quickly resolved.

Traditionally, email has been used to try and solve customer issues but email just doesn’t cut it in a mobile first world. It may be a few hours before a user sees an email, if they see it at all. Pulsate enables customer support agents to reach the user as soon as an issue occurs and to resolve the issue with real-time messaging in a mobile first interface that customer feels comfortable using.

If a customer runs into an issue completing a transaction on desktop, Pulsate enables a customer support agent to seamlessly reach out on mobile to help fix it.

Automated Customer Funnels

Even with the best will in the world, some users will run into issues with SCA and they won’t immediately respond to real-time help messaging or real-time offers of support. With Pulsate, those users can be added to automated customer funnels that follow up with a range of content throughout a specific period of time to provide assistance to the customer and help them complete the transaction or make a new purchase.

When a user receives this automated follow on content they can be brought back to the exact point in the checkout experience where they dropped off. This removes a significant amount of friction and it provides a great experience for the end user.

Keep an eye out for more content from Pulsate on how we can help you reduce the negative impacts related to the introduction of Strong Customer Authentication (SCA) on September 14th. We help companies around the world like NCR, SITA, Philz Coffee and Amadeus maximise conversions at every stage of the customer funnel. Schedule your personalized demo today!

HAVE YOUR SAY. LEAVE A COMMENT